A rich source of alpha

Can one perform better?

Our short answer is Yes.

Success is like rearing a delicate flower; space for true investment flair must be set within

a consistent and disciplined framework. Markets are dynamic in nature, sometimes

capricious, sometimes hyper-rational – a process which continually leads investors into

unchartered waters where new opportunities and risks must be identified and carefully

managed.

Safe navigation of troubled water lays the foundation for long-term investment success,

in which light we are proud of our strong performance throughout the 2000 Tech-bubble,

the 2008 GFC, European Crisis of 2011/12, and most recently 2020. Each of these crises

featured new problems requiring new solutions, 2020 arguably more than most.

Overall, post-1996 returns have exceeded our targeted 300-500 basis points

outperformance per annum versus benchmark. We hope there’s plenty more to come

and believe our approach provides a stable platform for durable long-term performance.

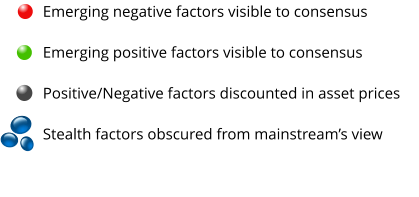

A forever problem

A key concern for all investors is missing market moves

that consensus can only explain after the event. It’s

especially irritating when the drivers have been visible for

some time, but their significance was somehow lost or

not fully recognised by mainstream analysts.

Instead of receiving accurate and unbiased forecasts,

investors end up with elaborate but retrospective sell-

side explanations for past events; typically delivered

under a cloak of superiority woven from obscure

acronyms, a jumble of financial ratios, and a mountain

of statistics. All presented within a reassuringly thick

research report.

The two most important questions remain unanswered:

1. Which assets are most likely to perform?

2. Where is the next accident?

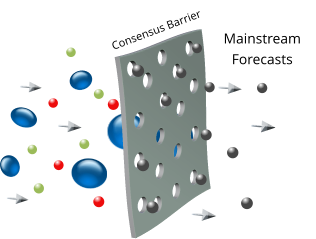

Large brokerage houses routinely process vast pools of

information, which renders their dismal failure to accurately

forecast asset prices something of a conundrum.

By synchronously turning the handles of standard valuation

models, there can be no doubt that the sell-side helps

markets digest prodigious quantities of new information.

Over time, however, the rigidity and homogeneity inherent

to these conventional techniques, biases sell-side analysts to

develop systematic blind-spots. These conceal the poorly

understood, unprecedented, and sometimes uncertain

factors that are so often the final arbiter of asset prices.

Forecasting failure is all but inevitable.

Why is the sell-side so dismal at predicting

asset prices?

A rich source of alpha

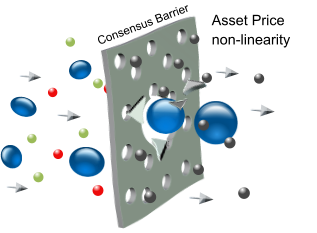

Partially obscured or poorly analysed ‘stealth factors’ cannot

be accurately discounted in stock and bond valuations via

the normal price discovery process. They are destined to lie

dormant for a while, before eventually popping-up to

trigger an asymmetric return profile following an earnings

or other surprise.

Alternatively, these ‘stealth factors’ may manifest themselves

gradually in the form of major secular trends. These include

the post-2010 fall in the cost of capital within fast moving

consumer stocks (FMCGs), major changes to the structure of

bank earnings, a fall in the natural real rate of interest (r*)

which is in turn exerting a profound effect on equity

valuations, and structural changes in the prices of sovereign

bonds, gold, volatility, etc.

In each case blindsided analysts are faced with a binary

choice: ‘recalibrate’ their models to the new market-traded

prices, or risk irrelevance, and possibly their jobs. What

follows is asset ‘pricing’ that masquerades as ‘valuation’ – a

process which only entrenches the underlying problem.

Deep seams of alpha are laid down for those few ahead of

the game.

Investment Approach

Images by Michael Gaida on Pixabay and Nikita Kachanovsky on Unsplash