We are dedicated to pursuing ideas and innovation to capture investment

opportunities that are overlooked, misanalysed, or simply lie beyond the

scope of conventional financial analysis. Over time, pools of unresolved

factors develop in these analytical blind spots.

Free to bubble beneath the market’s radar for a time, they leave few

traces in conventional risk metrics such as VAR, scenario analysis, and

extreme value modelling.

These unresolved factors are destined to pop-up somewhere, surprise

investors, and trigger price asymmetries which include unanticipated

stock/sector revaluations, yield curve shifts, and volatility spikes.

All of which represent deep pools of alpha for those ahead of the game,

and our long-term track record is based upon capturing them.

Roadmap to impending

opportunities and risks

Receive detailed investment cases to capture

asymmetric price returns hiding beneath the

radar of conventional forecasting techniques.

Our tools and investment strategies are

designed to give you a valuable advantage in

information and time.

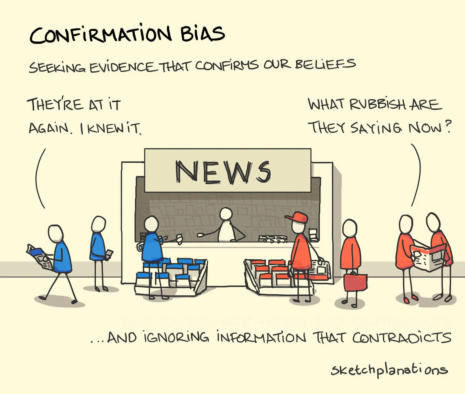

Protect from consensus traps

Investment insights used by the

most successful hedge funds

Create a more robust portfolio with forecasts that

look over the horizon of rigid and outdated valuation

methods.

Complimentary to bottom-up investing, we have

adapted CAPM, Equity risk premia evaluation, and

other CFA techniques to zero-interest-rate

environments.

Easy to overlay onto your existing investment

strategy, they support informed plans of action.

Find the research service that’s right for you

Subscription-based reports, forecasts, and consultancy with the information you need to make the right decisions.

Even good sell-side analysts are forced into

consensus mistakes.

Learn how to recognise and protect yourself from

building pressure points and turn them into

performance for your fund.

Images by Zak and NASAt on Unsplash, Illustration by Sketchplantations

Investment Research

Meaningful Forecasts.

Performing Stategies.