The Arrival of Inflation

Where did the ongoing inflation firestorm come from? Where is it headed? How did central

banks so spectacularly miss this in their forecasts?

Now, you won’t have a cat in hell’s chance of forecasting the path of ‘something’ unless you

have some idea where it came from, how it works, and where its headed. Having failed to

answer these basic questions, central banks only have themselves to blame for doing worse

than our proverbial cat.

Newer forecasting techniques free from presently obsolete economic dogma have fared

better – including Eriswell models explicitly designed for today’s circumstances. Back in

August 2021, a potentially violent inflation firestorm showed up on our radar screens. We

wondered whether we were just seeing a calibration or other technical problem.

Realising this inflation storm was not a technical malfunction would have profound

consequences on Eriswell’s asset allocation.

A full discussion of the causes and direction of inflation is beyond the scope of this note.

For now, just remember to be sceptical of the central banks’ “bad luck excuse”. While inflation

has certainly been magnified by war in Ukraine and by Covid-19, it was unambiguously NOT

caused by them. And central banks have known all about Covid since March 2020.

Given that central banks’ primary responsibility is to manage inflation, how did they get

it so very wrong?

Think of it like this: Up until the mid-90s, commercial aircraft were occasionally damaged by, or

even lost to, a weather phenomenon known as microbursts which pose a severe hazard to

aircraft during their landing and take-off stages. Today, most airports experiencing severe

thunderstorms are equipped with microburst detection systems and pilots are trained in the

appropriate responses should they accidentally hit one.

The inflation we see today is similar to microbursts before the introduction of these

safety systems. As late as autumn 2021, central banks perceived no imminent threat from

sustained inflation, incorrectly believing that the price rises beginning to take hold would

prove ‘transitory’.

This is because they possessed neither the systems to detect the early warning signs, nor the

appropriate policy responses when inflation started to run wild.

Stock and bond markets which had hitherto hung off every central bank utterance took

fright, and both have fallen a long way over the past year.

And for good reason, having blundered right into the middle of this inflation firestorm, it

would take a miracle to avoid a hard landing now.

Was it possible to protect portfolios from this inflation storm? Yes, it was. By flying around it!

Asset Allocation is the cornerstone of successful investing

Nothing is more important to long-term investment success than good asset allocation.

What assets you own, and in what proportions, account for around 90% of the variability in

observed returns across different portfolios.

Of course, great trading opportunities exist in timing the selection, purchase, and sale of

individual stocks and bonds. And you’ll hear terms like “volatility strategies”, “curve trades”,

“capital structure arbitrage” and suchlike bandied about. But do remember that you are

venturing deep into hedge fund territory here and that many of these strategies are

immensely complex both conceptually and numerically.

Stepping away from such high jinks, while future returns are unknowable, we do know

that equities generally tend to outperform bonds, commodities, and cash in the longer

term. And for good reason. It therefore makes sense to maintain an increased exposure to

equities for those investors with longer time horizons.

Having decided upon the general structure of your portfolio, it is normally wise to avoid

trading too much during periods of high market turbulence. This is because every time

markets sell-off big time, many novice investors react by drastically reducing their equity

exposure. Just like in early-2020 when Covid 19 struck. And every time, droves of them

subsequently find themselves left watching from the side lines as equity prices rise once

more.

Worse, many investors panicked back into stocks in late-2021, only to watch markets fall again

in 2022.

This observation is really the foundation of pursuing the classical “60/40 buy and hold”

strategy.

Is this an argument for passive investing?

Absolutely not! ‘Passive investing’ is basically just a version of ‘buy and hold’ where your

portfolio is comprised of stock, bond, and other index tracking funds. As opposed to ‘active

investing’ where your portfolios are comprised of individual stocks, bonds, active funds, etc.

There are arguments for both approaches, but you’ll run into big trouble either way if your

core-asset-allocation is caught offside by changing market conditions.

Think about it like this: Just because you are wise enough not to join hedge funds in their high-

octane financial aerobatics doesn’t mean it’s okay to stick with the same asset allocation you

decided upon some months or even years back. And then plough onwards into the eye of an

unexpected storm up ahead in the distance.

That would be nuts!

Moreover, the active/passive debate doesn’t even address the most basic asset

allocation questions. Which stock index should I invest in? The S&P500, Nasdaq Composite,

FTSE 100, DAX, Nikkei, Emerging Economy stocks, or some combination of them? Which sub-

indices are most closely matched to my investment objectives?

What should my equity/bond ratio be, the standard 60:40 allocation or something else? Which

maturity bonds should I buy, and in what currency?

What about gold and real estate?

And there’s the rub: Almost everything can be passively tracked, but what exactly should you

be tracking in the first place? That is the question!

What Eriswell did ahead of the 2022 Inflation Storm

Forecasting the storm back in August 2021 was one thing; figuring what to do about it quite

another. I’ll now share with you the thinking behind a core Eriswell Inflation strategy designed

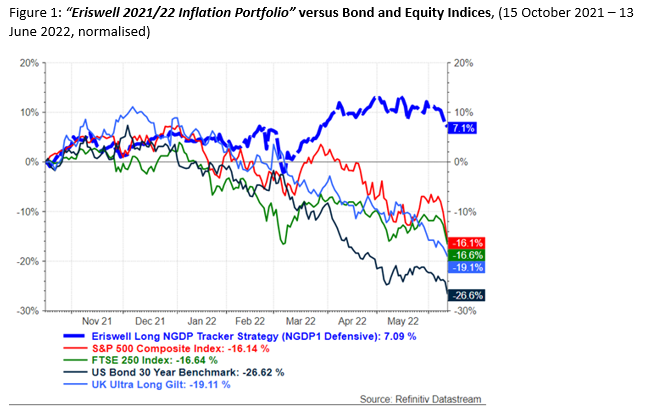

to navigate the past 12 months (Figure 1, dark blue line).

Normally bonds outperform stocks when an economy suffers a hard landing. All bets are

however off should an economy get smacked into the ground by a violent inflation storm. Our

economies may now hit nose first into the runway, they may suffer a wing strike, or they may

kangaroo down the runway, stop, and everyone can breathe a sigh of relief.

It’s impossible to know the exact form of the landing at this stage, other than it will almost

certainly be hard.

Thankfully, for the purposes of investing, we don’t need to know. Because we know

three things for sure:

a.

The zero-interest-rate worlds we are just exiting magnify the importance of human

behaviour many times over. This radically changes the rules of conventional economics to the

point of requiring new ideas and mathematical models to understand and forecast them.

b.

The passengers (investors) on this plane are people, people are prone to panic, and

panicking people are surprisingly predictable.

c.

Finally, in current circumstances, the interface between economies stuck at the lower

bound of interest rates (zero rates) and inflation can take the form of a violent non-linearity

not dissimilar to microburst weather phenomena. This has import asset allocation

implications.

By August 2021 it seemed clear to us that:

1.

Financial markets: They had grown overconfident in the ability of governments and

central banks to support economies come rain or shine. Profound misallocations of capital

were being actively encouraged by rampant liquidity injections leading to powerful rises in

property, stock, bond, real estate, fine art, and many other prices.

Combined with record low interest rates, this artificially created wealth gradually fed back into

our real economies, triggering a major intertemporal frontloading of consumer spending and

investment. Which ultimately morphed into the inflation and other problems we see today.

2.

Bonds: Our first major asset allocation decision – Avoid bonds! In particular, longer-

dated bonds which are highly sensitive to inflation. Also avoid sovereign bonds, corporate

bonds, and especially high-yield bonds. This seemed odd at the time because the classic de-

risking strategy would have been to reallocate towards ‘lower risk’ government bonds.

But whatever classical textbooks might say, this asset class was far from safe. To put it bluntly,

it was where vast pools of capital had come to accidentally die.

Figure 2 depicts the Austrian Government’s 100 Year AA+ rated sovereign bond, which has

fallen by 65% over the past year, giving investors a ‘crash’ course in the risks of investing in

long-dated bonds. That’s about the same loss as Bitcoin.

More generally, over the past year, benchmark government bonds including the USA and UK

25-30 year maturity bonds have behaved like speculative investments (Figure 1).

3.

Equities: This strategy almost fell out of our bond forecast. More speculative parts of

the stock market seemed highly exposed, especially ‘speculative technology’ which is highly

sensitive to longer-dated interest rates. This is why we chose to stand clear of major stock

indices which are chock full of exactly these stocks – especially the NASDAQ and S&P500.

Part 2 will take a closer look at what we actually did

Eriswell’s ‘2020/21 Inflation Portfolio’ was tilted towards individually selected stocks which

displayed a common attribute. Part 2 will explain which stocks and sectors we were attracted

to and why.

Over the past 12-months this portfolio has outperformed headline stock and bond indices by

around 25% (Figure 1).

No time however for a lap of honour yet as the plane hasn’t even touched the ground!

My key point here is that asset allocation is king. Between the early-1980s and the 2008

Global Financial Crisis, the underlying market dynamic was well suited to well-diversified ‘buy

and hold’ portfolios. In 2009 the rules changed, but ‘buy and hold’ continued to thrive as

central banks supported asset prices.

Those days are gone. The world changes and so must you:

“The art of progress is to preserve order amid change and to preserve change amid order”

Good luck and fair winds,

Mark Page

Through the Eyes of a Hedge Fund Manager, Series #1

| 19 July 2022

Eriswell Market Insights

‘Buy and Hold’ is in Deep Trouble

BY MARK PAGE, MANAGING PARTNER

+44 (0) 1932 240 121

info@eriswell.com

© 2026 Eriswell Capital Management LLP