Philosopher Karl Popper referred to the paradox of tolerance: “in order to maintain a tolerant society,

the society must be intolerant of intolerance.” In other words, if a so-called tolerant society permits

or succumbs to the existence of intolerant philosophies, it can no longer be considered tolerant.

In January this year, Eriswell wrote:

“Do

you

think

Defence

is

a

legitimate

investment?

What

about

nuclear

weapon

guidance

systems?

In

2006,

UK

Defence

giant,

BAE

Systems

was

blacklisted

by

Norges

(Norwegian

sovereign

wealth

fund

and

largest

stock

investor

worldwide)

"because

they

develop

and/or

produce

central

components

for

nuclear

weapons".

Consistent with Norges, the ratings firm ‘ISS ESG’ assigns BAE a 10, its worst possible rating.”

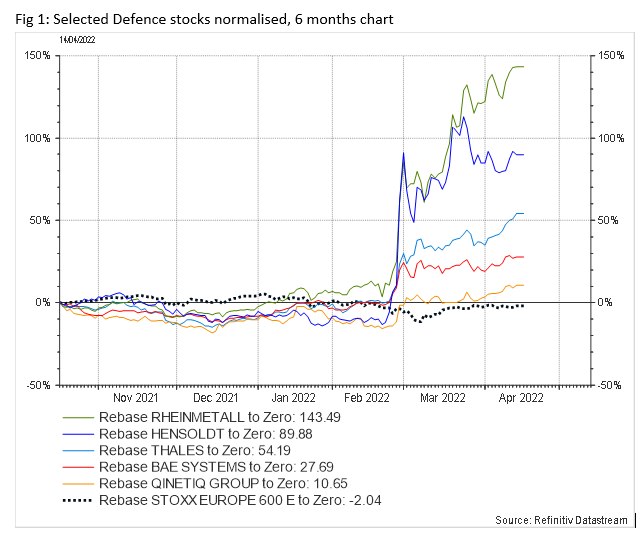

Defence stocks barely moved in the build-up to the invasion of Ukraine. Only to skyrocket on

Thursday 24 February 2022, the day Russia invaded (Figure 1). Other affected assets reacted

with similar shock. This was despite consistent warnings from Western Intelligence agencies that

the 150,000+ Russian army marshalled on Ukraine’s borders was poised to attack.

This type of real-time commentary represented a major policy shift for spy agencies. Especially

for the CIA, which has historically feared that declassifying sensitive intelligence too swiftly could

potentially endanger its operations.

In a departure from this policy, in January and February 2022, the CIA began to strategically declassify

contemporaneous intelligence as a weapon to counter false narratives emanating from Russia.

Why did financial markets not listen to the CIA and others and price rising tensions into

financial assets well ahead of the ultimate invasion?

Financial Markets’ Russian Fallacy

Prior to the invasion of Ukraine, the financial community engaged in a groupthink diametrically

opposed to what – aside from France – the big Western intelligence agencies were warning. (The head

of French military intelligence, Gen Eric Vidaud, would subsequently be fired on 31 March for failing to

predict the Russian invasion.)

A groupthink which went like this:

Putin the ‘great strategist’ fully recognised that he possessed neither the domestic support for, nor a

geostrategic interest in subjugating Ukraine. Apparently, all NATO had to do was offer assurances about

forward weaponry deployment in Eastern Europe and a French brokered de-escalation would swiftly follow.

Which led the financial community into an even bigger mistake; believing that even if Russia did invade

Ukraine, fragmented Western sanctions would be too weak to seriously threaten the Russian economy.

Unless Europe stopped Russia from selling its oil and gas overseas, which given Germany and other EU

nations strategic overreliance on Russian gas, would end up hurting European economies and consumers

more than Russia.

This blasé assessment of Putin’s geostrategic intentions and abilities saw financial markets shocked

by the eventual invasion when it happened.

The Western media also got Ukraine wrong

Most of the world now stands in solidarity with Ukraine, but it’s worth remembering that just a year

ago, the British, French, and German medias were all decrying endemic corruption in Ukraine,

alongside the fact that Mr Zelensky and many of his colleagues were named in the Pandora Papers.

Those who questioned this view were decried as naïve.

This seems unthinkable today with Zelensky, now seen as a flawless hero and democrat desperately

trying to hold off a barbaric Russian attack.

With no recognition of past interpretational mistakes, Ukraine is now viewed as an important

emerging European democracy alongside exhortations to adapt EU Institutions and laws to fast-track

Ukraine into the EU. And possibly NATO later. These are the same people who dismissed Ukraine as

fundamentally un-European just a few months ago.

Could political and media opinion swing once again, and conclude that Ukraine does, after all, suffer

from serious flaws? Might Western security services – perhaps even Ukrainian citizens – subsequently

conclude that Zelensky dragged Ukraine into a needless and brutal conflict?

Might the EU decide that it simply couldn’t afford to rebuild Ukraine; it can barely afford to support

Italy and Greece?

European rearming is a political decision

From the perspective of an individual investor, shunning defence stocks, aerospace companies,

energy companies, miners, and other sectors is entirely fair. It’s equally fair that asset managers

create ESG portfolios that reflect these preferences.

However, for asset managers to take this as a cue to wrap themselves in the flag of virtue, and then

wade into debates about the morality of nuclear deterrence, the weapons systems used by our

militaries, and geostrategic matters such as energy security…

…...well, that feels like wild overreach.

It is democratically elected politicians, not asset managers, who must decide upon the use of nuclear

deterrence, the composition of our militaries, and ultimately the declaration of war. That is not to say

we have any blind faith in politicians; we don’t. Simply that they are subject to more public scrutiny

and controls while performing the tasks they were elected to perform.

And decide they did.

On Sunday 27 February, during an emergency session of the Bundestag, Chancellor Scholz

announced a massive €100bn boost to Germany’s armed forces, together with a commitment to

increase trend German defence spending. The EU for its part ditched treaty prohibitions on the

funding of live military campaigns, making an offer of €500m of military assistance to Ukraine, with a

ceiling of €5bn.

Germany’s rearming represents a historic shift from over fifty years of Ostpolitik – engagement with

the East. Ostpolitik was developed by Egon Bahr, an advisor to SPD Chancellor Willy Brandt in the

1960s, who helped by Henry Kissinger, hoped to foster a relationship between Germany and East

Germany/USSR, with the future aim of German unification.

Following reunification in 1990, an altered version of Ostpolitik was led by SPD Chancellor Gerhardt

Schröder, who later became a close friend and supporter of Vladimir Putin. In which capacity

Schröder became the Chairman of Nord Stream 2 and he is currently on track to join Gazprom’s main

board. This strand of pro-Russian thinking underpins a strong pro-Russian faction within the SPD

today.

The key point is this: Rearming is a sensitive issue for Germany whose history has been dominated

by war and reparations since Bismarck became the first Chancellor of modern Germany in 1871.

Rearming is a political decision which reflects the needs, fears, and ethics of German citizens.

Conflicts of interest at the heart of Europe’s Finance Industry

The ESG asset management industry – operating under the same rooves as private bank arms of the

same institutions – has encouraged Europe to increase its strategic dependence on Russian energy.

While Europe’s private banks were simultaneously courting vast sums of money from the very

oligarchs who stood to benefit from this dependence.

Perhaps no surprise that a 2016 PWC Study found the finance sector to be the least trusted in the UK.

Only 12% of people reported trusting their asset manager and only 15% trusted their investment

bank.

It seems entirely inappropriate to welcome this group of asset managers, private banks, oligarchs,

and other business interests into debates about rearming, strategic energy dependence, etc.

At the very least, without full disclosure of their deep conflicts of interest.

Could Russia trigger wider military conflicts?

Putin’s invasion of Ukraine is arguably Russia’s biggest military blunder since the 1904-05 Russo-Japan

War, when Russia attacked Japan to capture a warm-water Pacific Ocean port. While WWI and WWII

were larger conflicts, they were both forced upon Russia. The Russo-Japan war was not, and it would

see the Russian army crushed by Japanese forces. Leading to domestic unrest in Russia like we see

today, with Russian families angry at losing their young to a foolish war.

Tsar Nicholas 2’s credibility never recovered. He would limp on until the 1917 February Revolution,

which would spell the end for him and his Romanov dynasty.

How much better will Putin fare today?

Bear in mind that Russia still yearns for a warm water port with access to the world trade

routes. Vladivostok on Russia’s East Coast is far from Russia’s industrial heartlands, Russia’s Black Sea

ports are a long way from the Straights of Gibraltar, and St Petersburg is mired in winter ice.

From a logistical trade perspective, Russia’s only decent ice-free port, Kaliningrad – the base for its

Atlantic Navy fleet – is sandwiched on the Baltic Sea between Poland and Lithuania. Land access from

mainland Russia to Kaliningrad first runs through Belarus, and then across NATO territory – either

Lithuania or Poland.

Putin has long dreamt of winning a land corridor to Kaliningrad.

Russia may have been seeking to test NATO in Ukraine to see how far it could go. Whatever Putin’s

reasoning, it is now clear that invading Ukraine was a disastrous foreign policy blunder.

Russia has accidentally engineered what it feared most: Deep changes in the thinking amongst

peaceful Western powers, who are once again refocussing their industrial machinery for the purpose

of war. Worse, Russia must now face the nightmare of renewed EU and possibly NATO expansion to

the Eastern flanks of Ukraine, or a yet-to-be-drawn new Donbas border.

This war is a mistake from which Russia must now step back.

Would Putin be trusted if a deal is reached? Could he break the international unity against him with a

peace deal? Will he be deposed if this war continues? Might he be replaced by a new more West-

friendly leader? Or might Russia be turned into a renegade superpower version of renegade Iran?

All of these are unknowns.

Whatever the outcome, most will increase the risk of conflict in Europe

Sweden and Finland are already poised to join NATO and on Thursday 15 April Russia warned that,

should they choose to join, it will respond by deploying its nuclear capable Iskander short-range

ballistic missiles and hypersonic missiles within the European exclave. These missiles are specifically

designed to target high-value targets including US Aircraft Carriers and Aegis Class Destroyers.

The sinking of the flagship Russian Cruiser Moskva in the Black Sea Thursday occurred as CIA

director, William Burns, warned that Russia may resort to using low-yield tactical nuclear

weapon in light of his country’s military setbacks: “Given the potential desperation of President

Putin and the Russian leadership … none of us can take lightly the threat posed by a potential resort

to tactical nuclear weapons or low-yield nuclear weapons.”

The game has now moved beyond crude boycotts of Western defence and energy stocks.

And onto what a New Deal with Russia might look like from a security, logistical, and legal

perspective. Whatever the ethical optics of such a deal.

For Europe now faces a short-term existential threat: Russia is being increasingly humiliated in

the field of conventional warfare and is now losing prime military assets to a Ukrainian army donning

advanced NATO weaponry.

It is naïve to believe that a peaceful ending can be achieved by NATO surrounding Russia – which

possesses the world’s largest stockpile of nuclear weapons – from its border with Finland to the

North, to its Baltic port of Kaliningrad, and possibly to somewhere close to the Donbas border to the

South.

In any event, NATO was formed part of the United States’ Cold War fight against communism, not

against repression by foreign dictators which were generally deemed too dangerous to tackle.

With the Cold War won, the West must be careful not to impose a dated NATO-centric solution that

turns out to be worse than the problems we face with Russia.

Russia’s financial troubles could easily become ours

Russia is no tinpot country and its economy is being devastated by Western sanctions. Rouble-

based inflation is running wild, Russia’s supply chains and production capacity are being severely

impacted, large chunks of its foreign exchange reserves are frozen, and its airlines are being denied

spare parts.

Russia is being forced to reconfigure its economy towards China, a messy process under which

unemployment will skyrocket and labour productivity will collapse.

These changes will alter the balance of global power.

How might the consequent disruption in global supply chains, energy security, and commodity flows

impact our Western economies? Might Western bond yields and credit spreads jump to levels

requiring renewed central bank monetisation, even as inflation is running wild?

Financial contagion is now a real possibility and investors must take the risk seriously.

Conclusion

Europe now faces a dangerous crossroads, and this is no time to outsource your conscience to asset

managers and corporate seeking CEOs where profit is the name of the game.

It is your money, and like religion, you must decide upon an ethical investment framework that feels

right for you.

Harsh to say, but through its profit-seeking stance on defence, energy, commodities, etc., the ESG-

industry has undermined the very reasons for its existence. For if supporting public safety and

democracy are not key ESG objectives, it’s hard to know the point of it.

This is not to say financial types should stay out of the debate on public betterment. The

premise of the 18th Century Enlightenment was a belief that the Church was not a prerequisite to

"good" or “moral” behaviour. Education, science, and reason were seen as better tools to promote

social good.

It is in this educational role that asset managers have a role to play, starting with a policy of

radical honesty:

•

Accept we are not the moral arbiters of society and be careful when seeking to influence the

decisions of democratically elected governments.

•

Accept that the finance industry is not very good at geostrategic predictions and that second

guessing the likes of the CIA is plain daft.

•

Recognise and mitigate the deep conflicts of interests that exist within many financial firms and

asset managers.

•

Finally, and in some ways most controversially, admit that it is almost impossible to reliably

distinguish ‘good’ companies from ‘bad’. To illustrate this, back in 1856, the UK industrialist Henry

Bessemer devised a new industrial process that reduced the price of steel from around £30 to £6

per ton. This would go on to power a new stage of the industrial revolution: high-pressure steam

engines, railways, shipbuilding, infrastructure, public health, etc.

What nobody foresaw at the time was that the massive coal industry which came alongside

deepening industrialisation would sow the seeds of the ‘ecocidal’ climate externalities we see today –

i.e., global warming.

There will be many more asset price moves born out of the changing kaleidoscope of world order.

Moves which will give birth to good and bad businesses alike.

Mark Twain’s words might help those hoping to capture them, and those who simply hope to

distinguish the good from the bad:

“It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So”

Mark Page

Managing Partner

Economies and Capital Markets Series #10

| 17 April 2022

Eriswell Market Insights

Ethical Investing failed Ukraine

BY MARK PAGE, MANAGING PARTNER

+44 (0) 1932 240 121

info@eriswell.com

© 2026 Eriswell Capital Management LLP