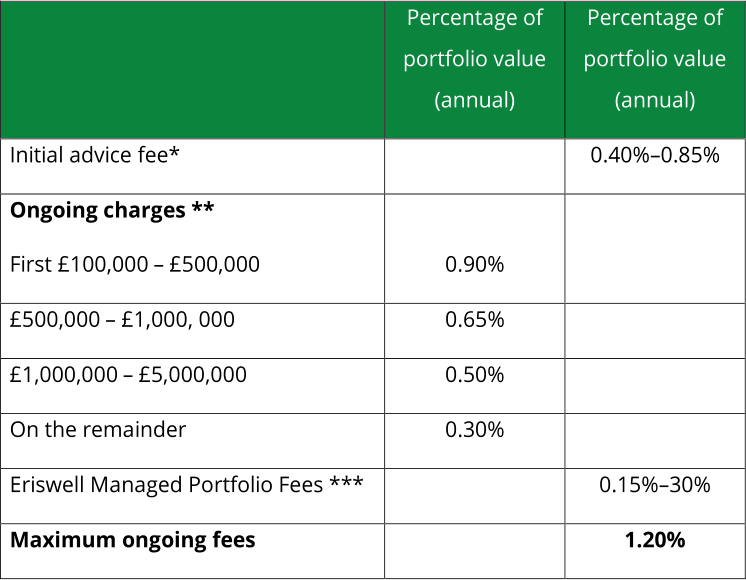

Annual Charge Structure

At Eriswell we are aware of the corrosive effect of excessive fees

and remain committed to keeping them low. Our current rates are

over 60% below the 2.83%* per annum market average.

Simple and transparent fee structure

*Initial Advice fee: this is a one-off charge to understand your requirements,

set objectives, and map a plan to achieve them. Bespoke packages available.

**Ongoing Eriswell charges: these are for ongoing investment advice and for

the servicing, administration, and safe custody of your investments.

***Eriswell Managed Portfolio Fees: we charge between 0.15% and 0.35% per

annum for our in-house Managed Portfolio Funds. Additional fees may be

payable to any externally managed funds within your portfolio.

Year 1 Initial Advice Rebate:

To help you off to the best possible start, we offer a 35% rebate of

the Initial Advice fee upon the completion of your first year as an

Eriswell client.

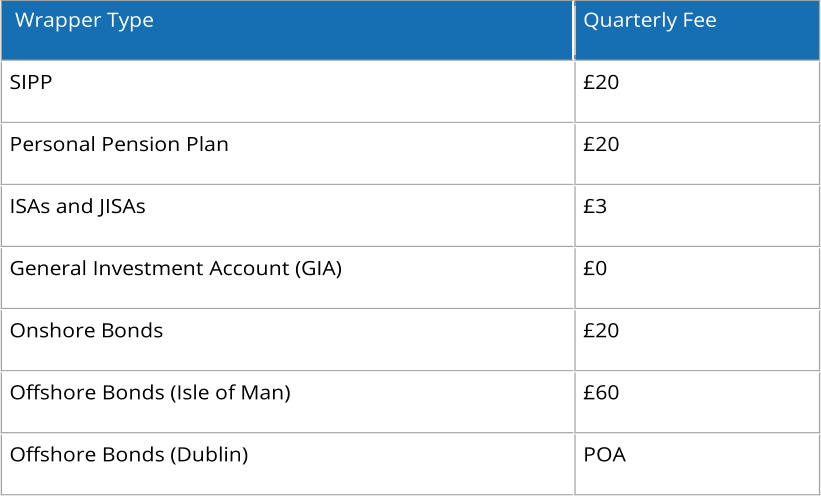

Investment Wrapper Charges:

Dealing Charges:

Single Transactions: Up to £3.75 per transaction (reduced rates apply when

multiple transactions in the same security are executed by Eriswell.

Express Transactions: £10 when trades are executed by our broker as soon as

possible

Regular Transactions: £0.50. Where a client is carrying out a regular buy or sales,

e.g. monthly, quarterly, half-yearly or yearly.

Note: when we use outside parties to execute transactions, different charges may

apply according to jurisdiction, security type, stock exchange charges, transaction

value, etc. We will pass on any such charges at cost.

Buy Commission:

We charge a Buy Commission of 0.05% of the value of investment purchases. No

Buy Commission applies to any portfolio whose aggregate value exceeds £300k in

the relevant quarter.

Family Discounts:

At our discretion, we will consolidate portfolios belonging to immediate family

members (usually living at the same address) in order to maximise their aggregate

Annual Commission rate reduction. For example, a child’s ISAs and JISAs would be

included as part of their parent(s)’ portfolio.